Best Life Insurance Company in Pakistan is described here briefly. When choosing a life insurance company in Pakistan, it is important to consider factors such as financial stability, product range, premiums, customer service, and claim settlement ratio. This will ensure that you select a reputable company that meets your needs and provides the necessary coverage and support. Additionally, it is crucial to evaluate different policies from experienced and reputable companies and consider their financial strength ratings and discounts.

By following these steps, you can make an informed decision and choose the best insurance company in Pakistan for your financial needs. Overall, a thorough assessment of various factors is crucial in choosing the right life insurance company to provide financial security for you and your family.

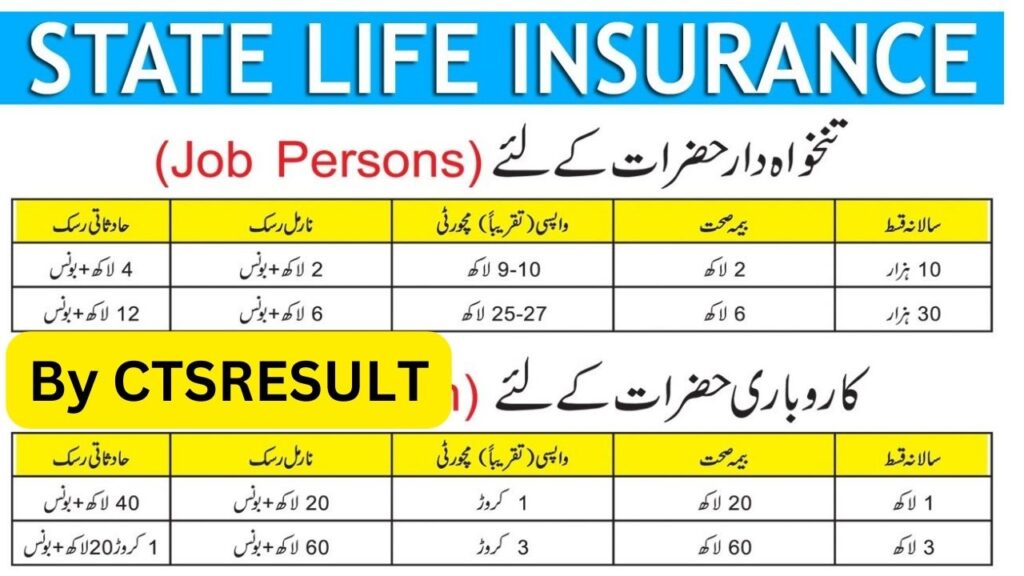

state life insurance policy in Pakistan

Life insurance in Pakistan offers policies tailored to diverse needs and budgets. Here’s a breakdown of the types of life insurance policies available:

1. Term Life Insurance:

- Provides coverage for a specific period (term).

- Guaranteed financial protection in case of the insured’s death during the specified term.

- Ideal for temporary financial protection or covering specific debts.

2. Whole Life Insurance:

- Get lifelong coverage with a death benefit and built in cash value.

Accumulates wealth over time while offering death benefit protection.

3. Endowment Policies:

- Combines a death benefit with a maturity benefit.

- If the insured survives the policy term, they receive the accumulated sum as a lump sum.

4. Unit Linked Insurance Plans (ULIPs):

- Combines life insurance with investment options.

- Premium is split between insurance coverage and investment in various units.

- Offers higher potential returns but comes with market risks.

5. Child Plans:

- Designed to secure a child’s future financial needs.

- Offers education funds, marriage funds, and other benefits upon maturity.

Factors to consider when choosing a life insurance policy include:

- Age: Younger individuals generally get lower premiums.

- Health: Pre-existing conditions can affect policy availability and premium rates.

- Income: Choose a policy with a premium you can comfortably afford.

- Coverage needs: Consider death benefit amount, policy term, and additional benefits.

- Investment goals: If wealth accumulation is a goal, consider ULIPs or whole life plans.

Some popular life insurance companies in Pakistan are:

State Life Insurance Corporation of Pakistan (SLIC)

- EFU Life Assurance

- Jubilee Life Insurance

- IGI Life Insurance

- Adamjee Life Insurance

- Pak-Qatar Family Takaful

best life insurance companies in Pakistan

Choosing the “best” life insurance company in Pakistan depends on your specific needs and priorities. To help you make an informed decision, here are some of the top contenders, along with their respective strengths:

Jubilee Life Insurance:

Jubilee Life Insurance is the largest private life insurance company in Pakistan, known for its strong financial performance and diverse range of products. They offer term insurance, whole life insurance, endowment plans, unit-linked plans, and health insurance. Their website, which can be found at https://www.jubileelife.com/, provides more information about their services and offerings.

TPL Life:

TPL Life Insurance is a joint venture between TPL Corp and AXA Group. They offer a range of innovative insurance products, including term insurance, whole life insurance, endowment plans, unit-linked plans, and health insurance. TPL Life Insurance is known for its strong digital presence and commitment to providing excellent customer service. For more information, you can visit their website at https://tpllife.com/.

Postal Life Insurance Company:

Here are some factors to consider when choosing a life insurance company in Pakistan:

1. Financial stability: It is important to select a company with a strong financial track record and a good reputation for claim settlement. This will give you peace of mind knowing that your claims will be handled efficiently.

2. Product range: Evaluate the range of products offered by the company and choose one that caters to your specific needs. This will ensure that you have the coverage you require and that you are not paying for unnecessary features.

3. Premiums: It is advisable to compare premiums from different insurance companies to get the best value for your money. This will help you identify the most cost-effective option without compromising on coverage.

4. Customer service: Select a company that has a solid reputation for customer service and responsiveness. This is crucial as you want to have a smooth experience throughout the duration of your policy and prompt assistance whenever you need it.

5. Claim settlement ratio: Look for a company with a high claim settlement ratio. This indicates that they have a good track record of paying out claims. This information can be obtained from reliable sources or through industry reports.

Considering these factors will ensure that you choose an insurance company that meets your needs and provides you with the necessary coverage and support.

life insurance Pakistan

Life insurance serves as a crucial financial tool, providing protection for your loved ones in the event of your death. It ensures that your family can maintain their financial security by covering expenses like funeral costs, outstanding debts, and everyday living expenses.

In Pakistan, numerous life insurance companies offer a diverse range of products tailored to meet your specific needs and budget.

life insurance corporation

As an individual, one of our primary responsibilities is to take care of our financial health. Without proper financial planning, our future goals and aspirations remain unfulfilled. Life insurance is an essential tool in financial planning, which provides financial protection to your family in the event of any uncertainties. Life Insurance Corporation of Pakistan (LIC) is the oldest and largest life insurance company in Pakistan, and it plays a vital role in the financial lives of millions of Pakistanis. In this blog post, we will take a closer look at the role of Life Insurance Corporation in financial planning.

life insurance plans

When choosing a life insurance plan, it’s important to follow these tips:

1. Determine your needs: Assess the amount of coverage and duration that fits your requirements.

2. Shop around: Obtain quotes from multiple insurance companies to compare options.

3. Consider your health: Understand that your health can impact the premiums you’ll pay.

4. Read the fine print: Thoroughly review and comprehend the policy’s terms and conditions before making a purchase.

How to choose best insurance company in Pakistan?

Here are few steps you must follow before choosing best insurance company in Pakistan:

1. Find an Experienced and Reputable Insurance Company

When choosing an insurance company, it’s crucial to consider their experience and reputation. A company’s track record can give you insight into the quality of their services, the reliability of their claims, and their level of customer service. Ask friends and family for recommendations or read online reviews to get an idea of what to expect.

2. Compare Policies Carefully

Before making a decision, take the time to compare and contrast policies from different insurance companies. Read the policy documents thoroughly and compare the benefits, features, and limitations of each policy. Analyze factors like premiums, deductibles, and coverage limits. If needed, consult independent insurance agents or brokers to help you choose the best policy for your needs.

3. Consider Financial Strength Ratings

It’s important to assess the financial strength ratings of an insurance company. These ratings reflect the company’s financial stability and ability to pay claims. Look for these ratings on reputable websites such as A.M. Best, Standard & Poor’s, or Moody’s.

4. Evaluate the Customer Service

Customer service can greatly impact your experience with an insurance company. Even if their policies seem great, it’s crucial to assess their level of customer service before making a purchase. Research online reviews to ensure they are reliable and responsive when it comes to inquiries or claims.

5. Keep an Eye out for Discounts

Insurance companies often offer discounts on policies. Check if your chosen company provides any discounts that you may be eligible for. Bundling policies, such as combining home and car insurance, may also result in discounted rates.